When extending credit terms to businesses, lenders and suppliers need a reliable way to assess potential customers’ creditworthiness. This is where commercial credit application forms come in. These forms enable lenders and suppliers to gather detailed financial and operational information about a business, allowing them to make informed decisions about whether to extend credit.

What is a Commercial Credit Application Form?

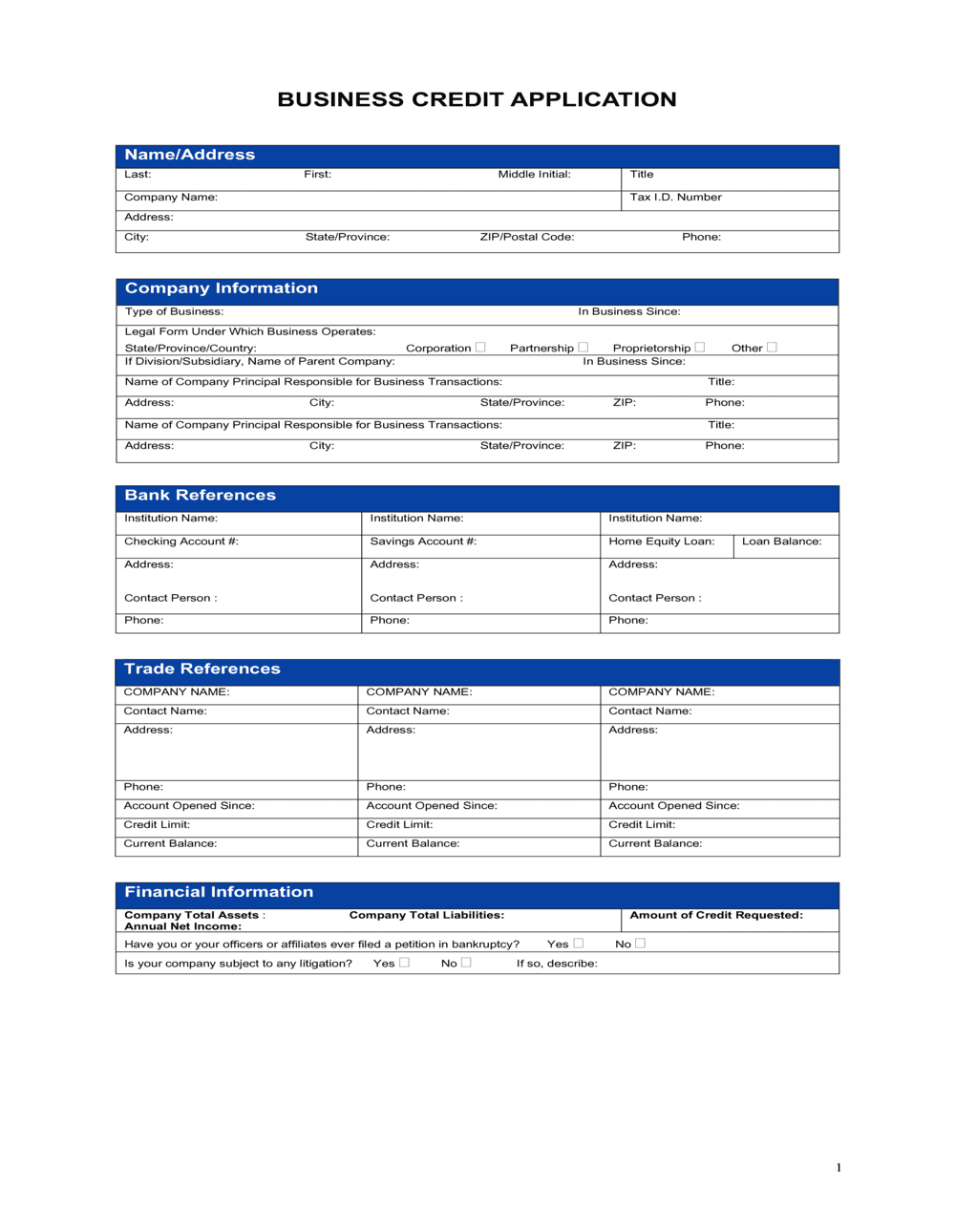

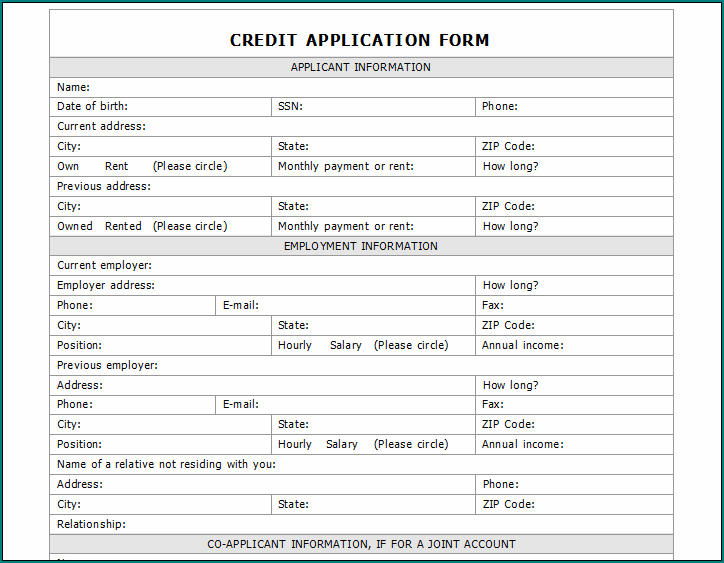

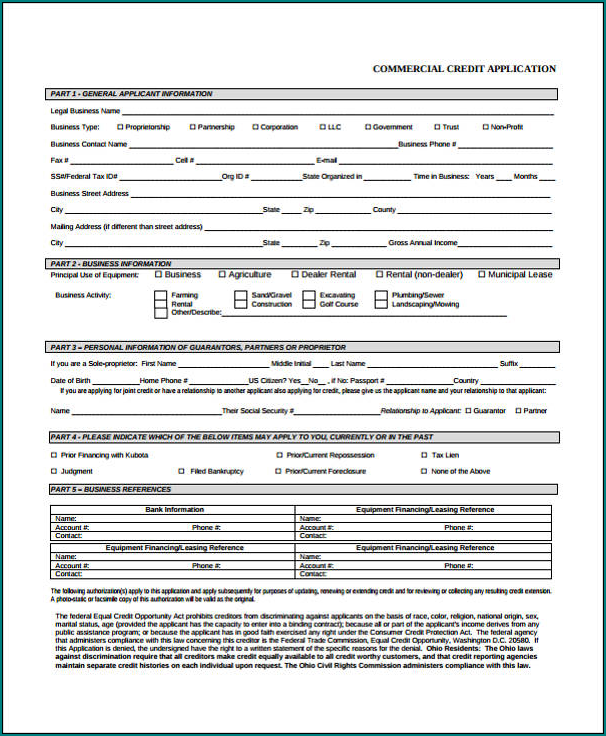

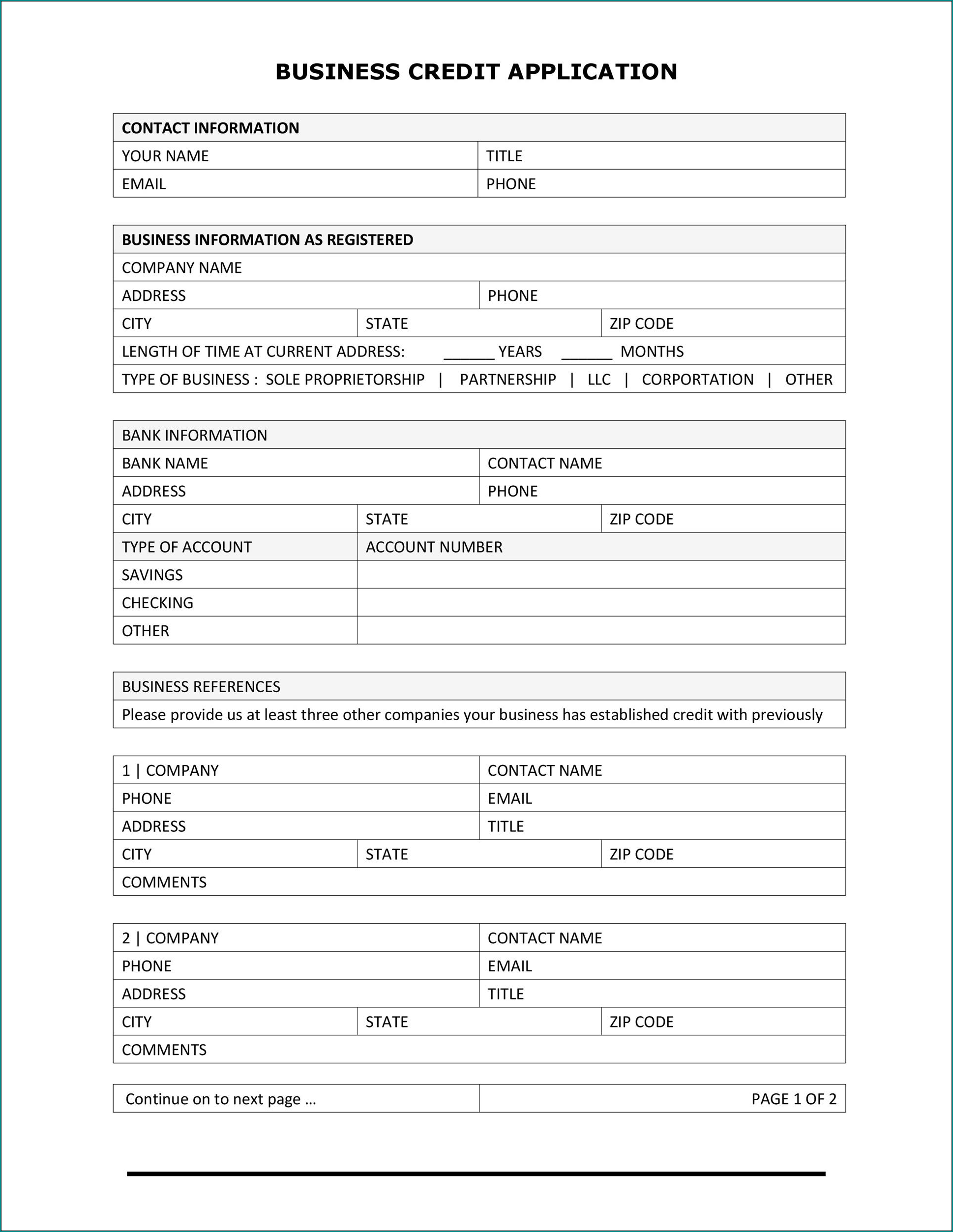

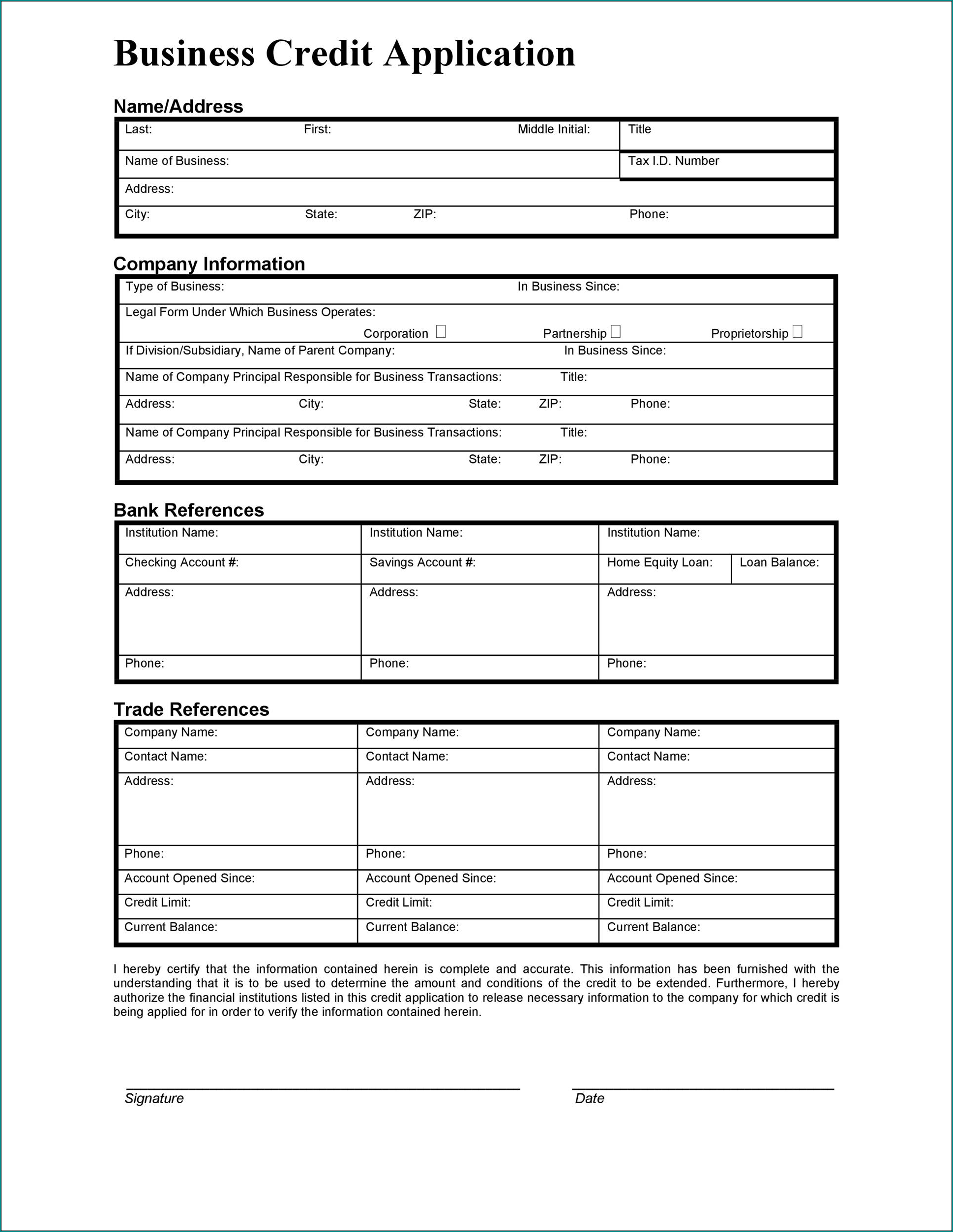

A commercial credit application form is a document that businesses use to gather important information from potential customers when they apply for credit. This form typically includes sections for the business’s name, contact information, financial statements, trade references, and other relevant details.

The purpose of this form is to provide lenders and suppliers with a comprehensive view of the business’s financial health and creditworthiness.

Why are Commercial Credit Application Forms Important?

commercial credit application forms are important for several reasons:

- Assessing Creditworthiness: By gathering detailed financial and operational information, lenders and suppliers can assess the creditworthiness of a business. This helps them determine whether the business is likely to repay its debts on time.

- Reducing Risk: Extending credit to a business always carries some level of risk. However, by gathering information through a credit application form, lenders and suppliers can minimize the risk of non-payment or default.

- Making Informed Decisions: The information provided in a credit application form allows lenders and suppliers to make informed decisions about whether to extend credit and, if so, on what terms.

- Establishing Credit Terms: commercial credit application forms help lenders and suppliers establish appropriate credit terms for each business. This includes determining the credit limit, payment terms, and any other conditions that may apply.

- Legal Protection: Having a credit application form on file can provide legal protection in case of non-payment or disputes. It serves as evidence that the business agreed to the terms and conditions outlined in the form.

How to Create a Commercial Credit Application Form

Creating a commercial credit application form doesn’t have to be complicated. Here are some steps to follow:

1. Determine the Information You Need

Start by deciding what information you need to gather from potential customers. This may include basic company information, financial statements, trade references, and other relevant details. Make sure to include all the necessary fields in your form.

2. Design the Form

Design a clean and organized form that is easy to read and fill out. Use clear headings and sections to guide applicants through the form. Consider using a template or online form builder to simplify the process.

3. Include Clear Instructions

Provide clear instructions on how to fill out the form. This can include explanations of specific terms or instructions on how to attach supporting documents. Make sure applicants understand what information is required.

4. Test the Form

Before using the form, test it to ensure everything is working properly. Check that all fields are accessible and that the form is user-friendly. Make any necessary adjustments or improvements.

5. Make the Form Accessible

Make the commercial credit application form easily accessible to potential customers. This can be done by offering it on your website, sending it as a downloadable PDF, or providing it in person at your business location.

6. Review Applications Carefully

Once you start receiving credit applications, review them carefully. Pay attention to details and verify the information provided. Follow up with any references or additional documentation as needed.

7. Protect the Data

Since credit application forms include sensitive financial information, it’s important to protect the data. Store the forms securely and limit access to authorized personnel. Consider implementing encryption and other security measures to safeguard the information.

Examples of Commercial Credit Application Forms

There are various examples of commercial credit application forms available online. These forms can serve as a starting point for designing your form or as a reference for understanding the type of information to include. Some examples include:

Tips for Successful Commercial Credit Application Forms

Here are some tips to make your commercial credit application form more successful:

- Keep it Simple: Avoid overwhelming applicants with excessive or unnecessary fields. Keep the form concise and easy to fill out.

- Provide Clear Instructions: Make sure applicants understand what information is required and how to provide it. Use clear and concise instructions throughout the form.

- Request Supporting Documents: Depending on the nature of the business, consider requesting supporting documents such as financial statements, bank statements, or trade references.

- Regularly Update the Form: Keep your commercial credit application form up to date. Review and revise it periodically to ensure it reflects any changes in your business requirements.

- Offer Assistance: Provide contact information or a point of contact for applicants who have questions or need assistance filling out the form. This can help increase completion rates.

In Conclusion

Commercial credit application forms are an essential tool for lenders and suppliers to assess the creditworthiness of potential customers. By gathering detailed financial and operational information, these forms enable informed decisions about extending credit terms.

By following the steps outlined above and implementing the tips for success, you can create a commercial credit application form that is effective and user-friendly.

Commercial Credit Application Form – Download