As businesses increasingly rely on credit card payments, it’s important to have a secure and efficient way to charge customers’ cards, especially when the cardholder is not physically present. This is where a credit card authorization form comes in handy. This form allows businesses to charge a customer’s credit card for recurring payments, subscriptions, or large purchases, while also providing a record of authorization and helping prevent fraud.

In this article, we will explore the many benefits of using a credit card authorization form, as well as provide tips for successful implementation.

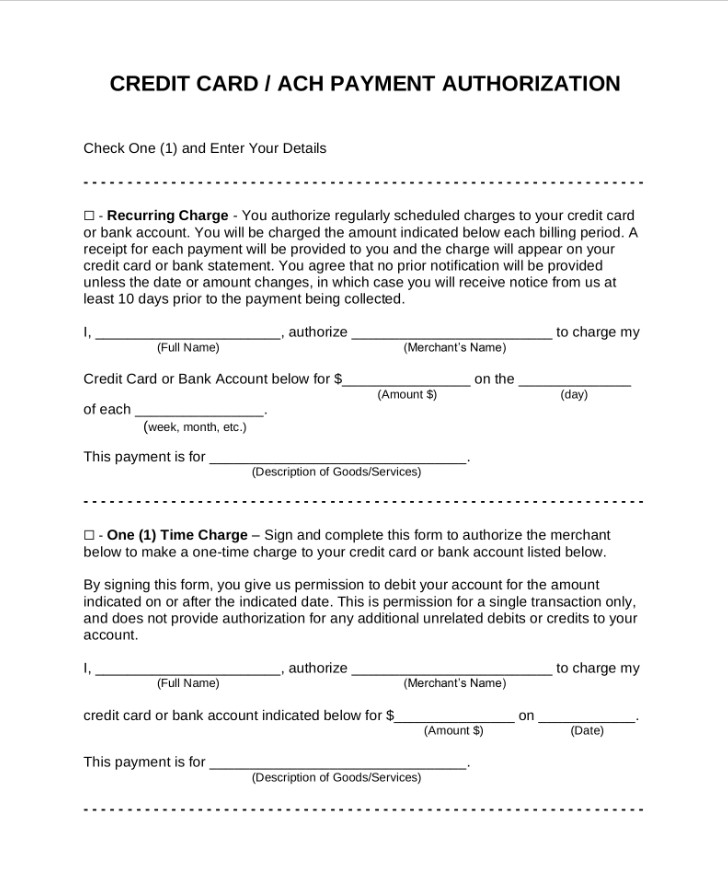

What is a Credit Card Authorization Form?

A credit card authorization form is a document that allows a business to charge a customer’s credit card for goods or services. It is particularly useful when the cardholder is not physically present, such as in the case of online purchases or recurring payments.

The form includes important information such as the customer’s name, credit card details, and the amount to be charged. By obtaining the customer’s signature on the form, businesses can have a record of authorization, which can be used as proof in case of disputes or fraud.

Why Use a Credit Card Authorization Form?

Using a credit card authorization form offers several advantages for both businesses and customers:

1. Convenience and Efficiency

A credit card authorization form streamlines the payment process for both businesses and customers. Instead of going through the hassle of manual credit card entry for each transaction, businesses can simply charge the authorized amount using the information provided on the form. Customers, on the other hand, can enjoy a seamless payment experience without the need to provide their credit card details every time.

2. Record of Authorization

Having a record of authorization is crucial for businesses in case of disputes or chargebacks. By obtaining the customer’s signature on the credit card authorization form, businesses can prove that the customer authorized the charge. This can help prevent fraudulent claims and protect businesses from financial loss.

3. Fraud Prevention

credit card authorization forms can be an effective tool in preventing fraud. By requiring customers to provide their credit card details and signatures, businesses can verify the authenticity of the transaction. This adds an extra layer of security and helps deter fraudulent activities.

4. Legal Compliance

Using a credit card authorization form ensures that businesses comply with legal requirements. Depending on the jurisdiction, businesses may be required to obtain written authorization from customers before charging their credit cards. By using a standardized form, businesses can easily meet these legal obligations and avoid potential penalties or legal issues.

How to Implement a Credit Card Authorization Form

Implementing a credit card authorization form in your business is relatively simple. Here are the steps to get started:

1. Design the Form

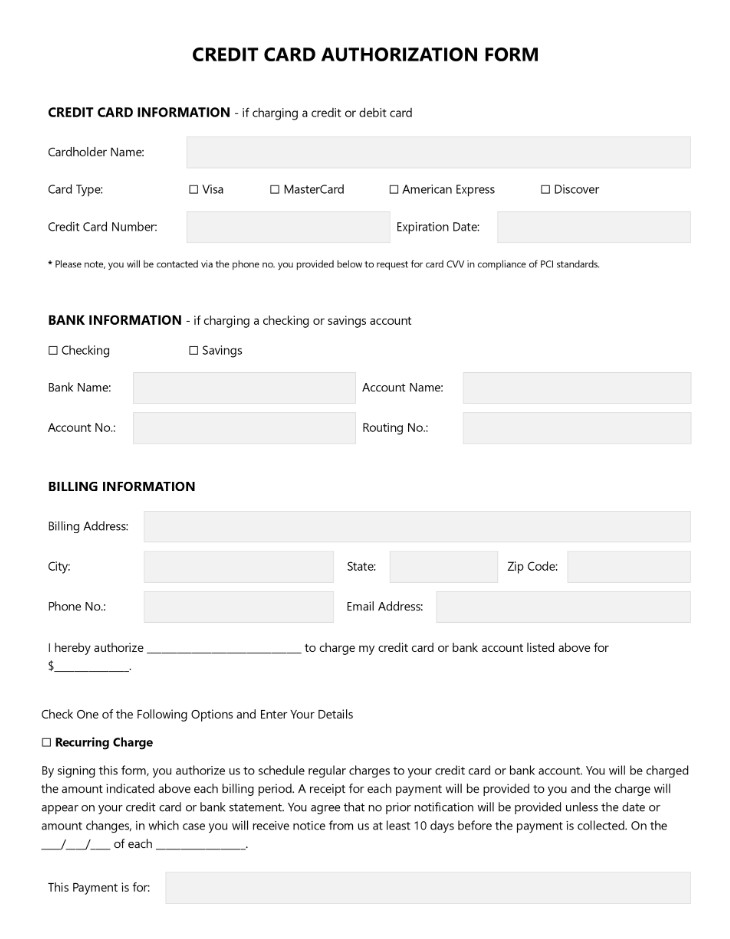

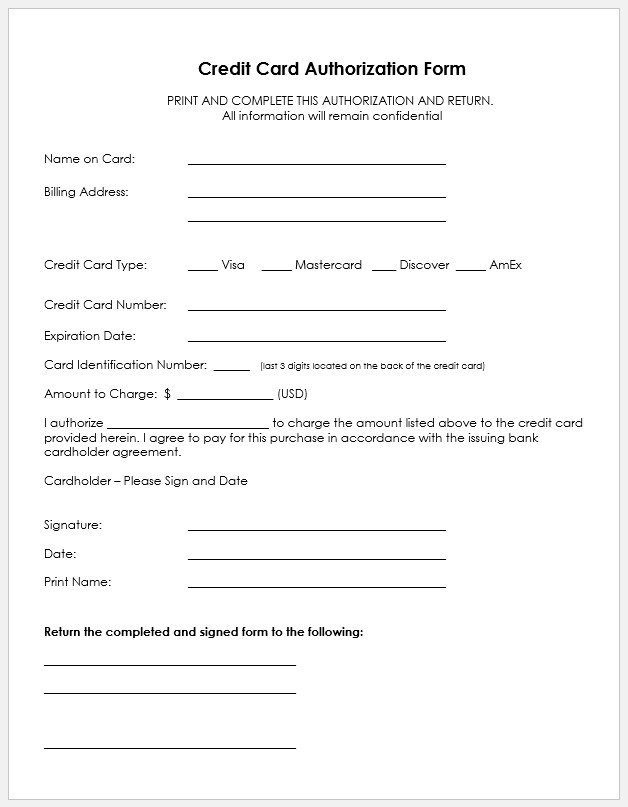

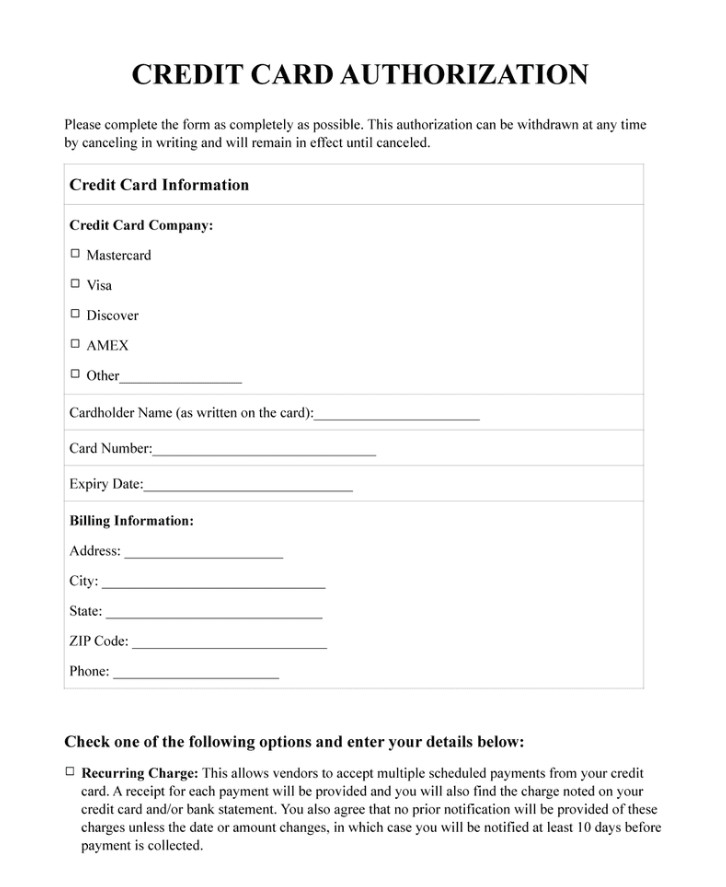

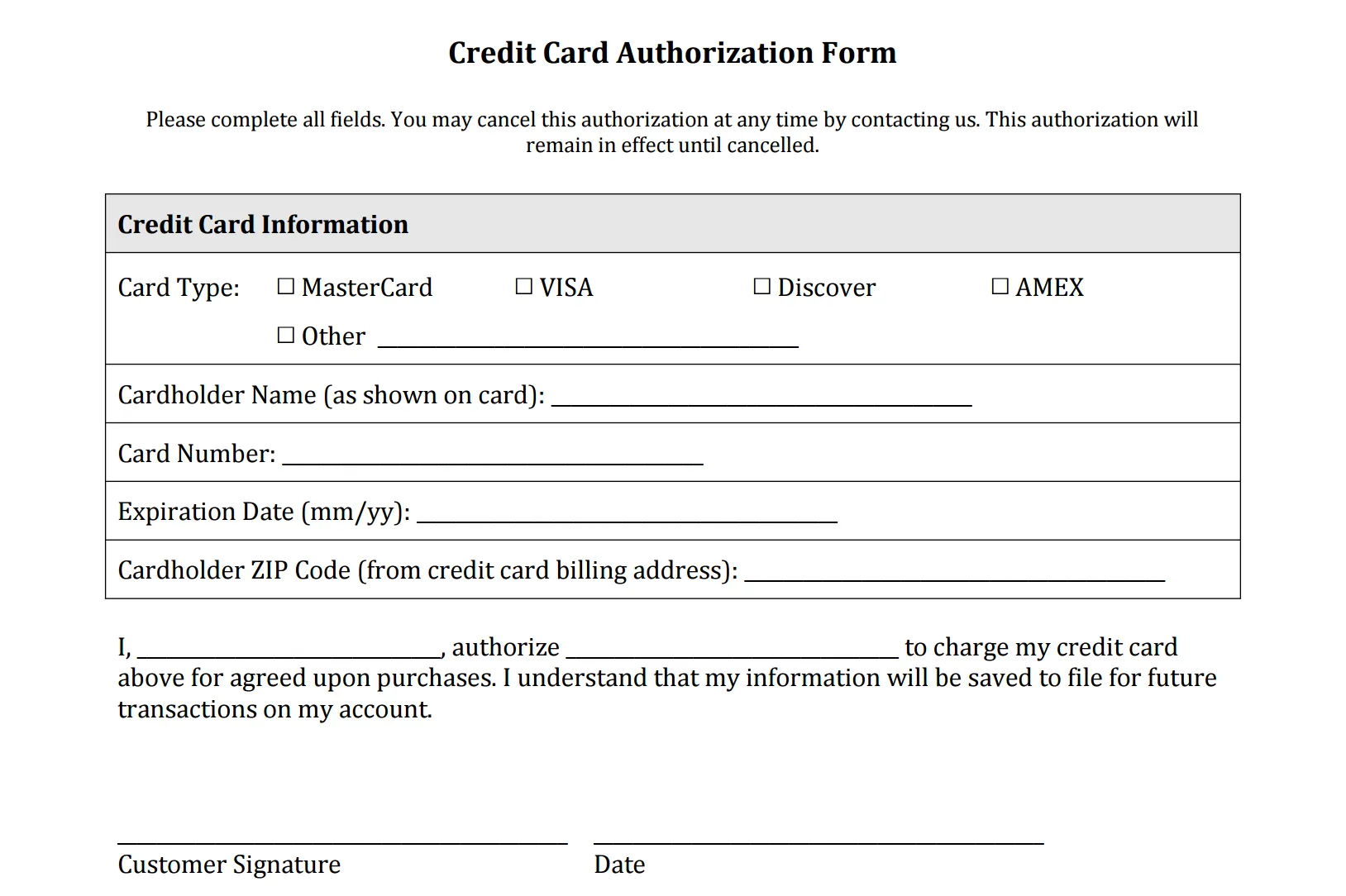

Create a credit card authorization form that includes all the necessary fields, such as customer name, credit card details, and authorized amount. Make sure to include a signature line for the customer to sign.

2. Obtain Customer Consent

Before using the form, businesses should inform customers about the purpose and use of the form, as well as obtain their consent to charge their credit card. This can be done through clear communication, such as including a checkbox on the website checkout page or sending an email with a link to the form.

3. Provide Clear Instructions

When presenting the credit card authorization form to customers, provide clear instructions on how to fill out the form correctly. Include information on where to sign and how to provide credit card details securely.

4. Securely Store the Forms

Once the forms are completed and signed by customers, it’s important to securely store them. This can be done electronically or in physical form, depending on the business’s preference and the security measures in place. Ensure that only authorized personnel have access to these forms to protect customer data.

5. Regularly Review and Update

As with any business process, it’s important to regularly review and update the credit card authorization form to ensure it aligns with industry best practices and any changes in legal requirements. This will help maintain the effectiveness and security of the form.

Examples of Credit Card Authorization Forms

There are numerous examples of credit card authorization forms available online. Businesses can customize these forms to suit their specific needs and branding. Some examples include:

Tips for Successful Implementation

To ensure the successful implementation of a credit card authorization form, consider the following tips:

- Communicate with customers: Explain the purpose of the form and how it will be used to charge their credit card. This will help build trust and minimize customer concerns.

- Ensure form security: Implement appropriate security measures to protect customer data and prevent unauthorized access to the forms.

- Regularly update the form: Stay up-to-date with the latest legal requirements and industry best practices to ensure the form remains compliant and effective.

- Train employees: Provide training to employees who handle the credit card authorization forms to ensure they understand the process and can assist customers if needed.

- Monitor and review: Continuously monitor the effectiveness of the form and review any feedback or issues raised by customers or employees. Make necessary improvements to the process as needed.

- Seek legal advice: If you have any concerns or questions regarding the implementation of a credit card authorization form, consult with a legal professional to ensure compliance with applicable laws and regulations.

Conclusion

A credit card authorization form is a valuable tool for businesses that rely on credit card payments. It provides convenience, the record of authorization, fraud prevention, and legal compliance.

By following the tips for successful implementation and using appropriate examples, businesses can streamline their payment process and protect themselves and their customers from potential fraud or disputes. Implementing a credit card authorization form is a proactive step toward ensuring secure and efficient transactions.

Credit Card Authorization Form – Download