Direct deposit is a popular method that allows individuals to receive payments directly into their bank accounts without the need for physical checks. To set up direct deposit, employers or other payers typically require individuals to complete a direct deposit enrollment form. This form authorizes the payer to electronically deposit funds directly into the individual’s bank account, providing the necessary bank account details for the process.

In this article, we will explore what a direct deposit enrollment form is, why it is important, how to complete one, and provide examples and tips for successful enrollment.

What is a Direct Deposit Enrollment Form?

A direct deposit enrollment form is a document used to authorize an employer or other payer to electronically deposit funds directly into an individual’s bank account. It essentially provides the necessary bank account details to set up direct deposit for a person’s paycheck or other payments.

This form typically includes fields for the individual’s name, address, social security number, bank account number, routing number, and the name and address of the bank. By completing and submitting this form, individuals give their consent for the payer to deposit funds directly into their bank account, eliminating the need for physical checks.

Why is a Direct Deposit Enrollment Form Important?

A direct deposit enrollment form is important for several reasons:

- Convenience: Direct deposit offers a convenient way for individuals to receive payments. Once the form is completed and submitted, individuals no longer have to worry about physically depositing checks at a bank.

- Efficiency: Direct deposit eliminates the time-consuming process of depositing physical checks. Funds are deposited directly into the individual’s bank account, saving time and effort.

- Security: Direct deposit reduces the risk of lost or stolen checks. Electronic deposits are more secure and minimize the chances of fraud or identity theft.

- Timeliness: With direct deposit, individuals receive their payments faster. Funds are deposited directly into their bank accounts, allowing for immediate access.

- Cost savings: Direct deposit eliminates the need for paper checks and postage, resulting in cost savings for both the payer and the individual.

How to Complete a Direct Deposit Enrollment Form

Completing a direct deposit enrollment form is a straightforward process. Here are the steps to follow:

- Obtain the form: Request the direct deposit enrollment form from your employer or payer. This form may be available on their website or through their HR department.

- Gather the necessary information: Collect the required information, including your name, address, social security number, bank account number, routing number, and the name and address of your bank.

- Read the instructions: Take the time to read the instructions provided on the form. Ensure that you understand each section and what information is required.

- Fill in the form: Carefully complete each section of the form, providing accurate and up-to-date information. Double-check your entries to avoid errors.

- Review and sign: Review the completed form for any mistakes or missing information. Once you are satisfied, sign the form to authorize the direct deposit.

- Submit the form: Submit the completed form to your employer or payer. Follow any additional instructions provided, such as mailing the form or submitting it electronically.

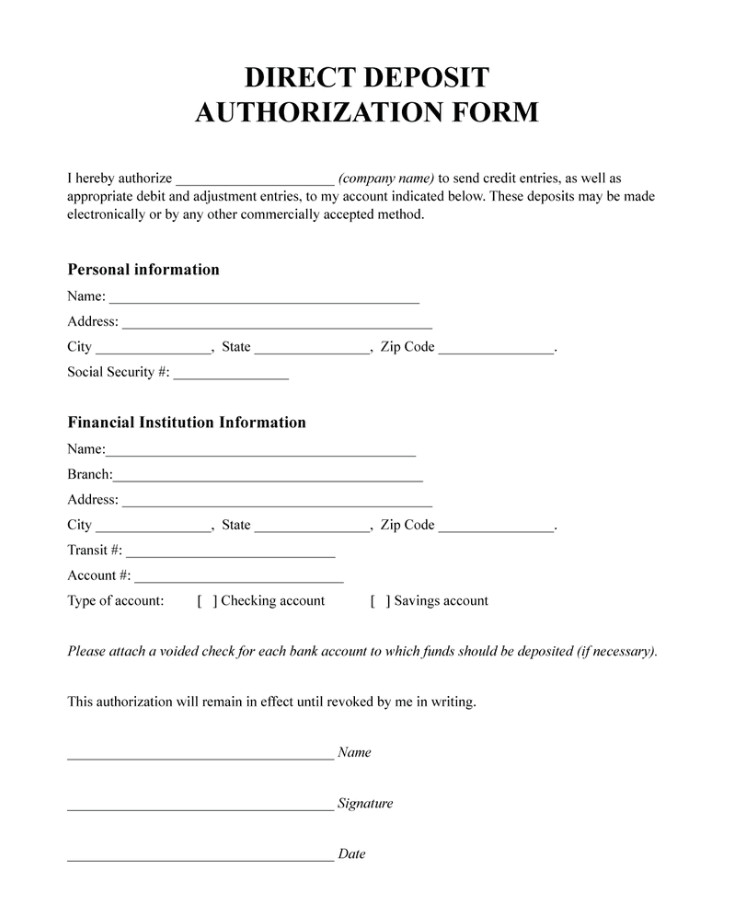

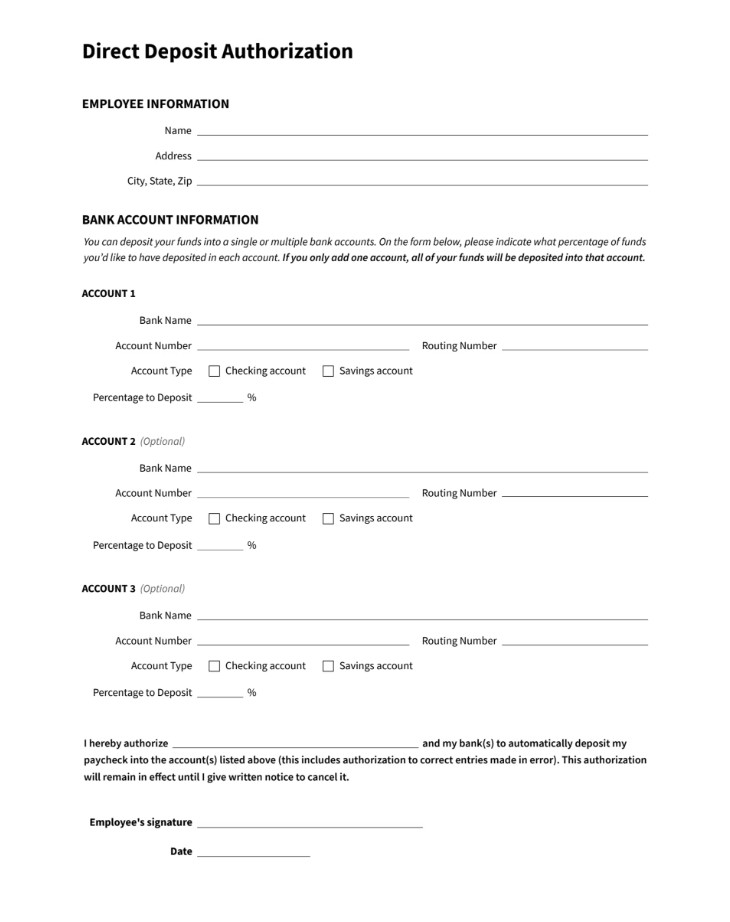

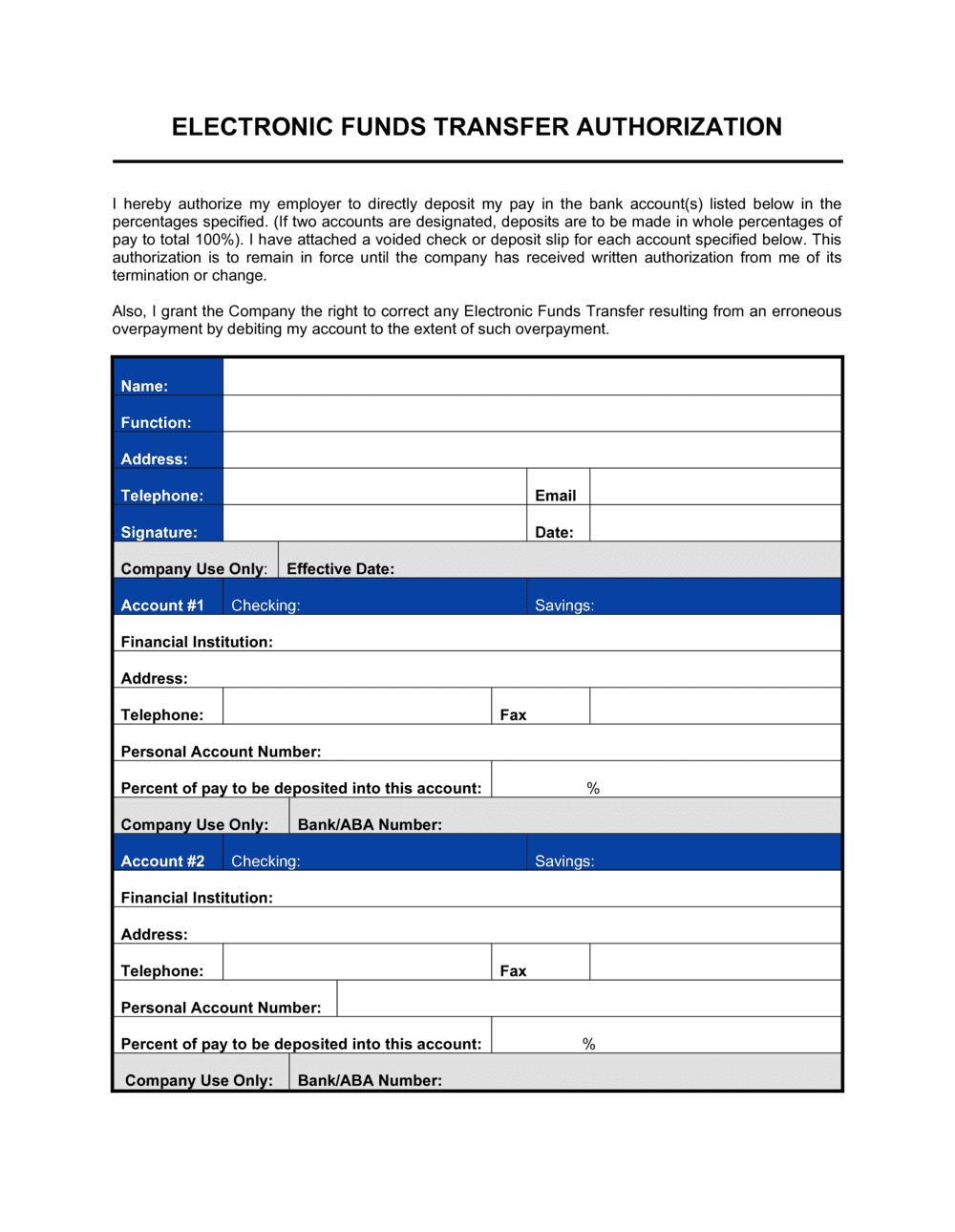

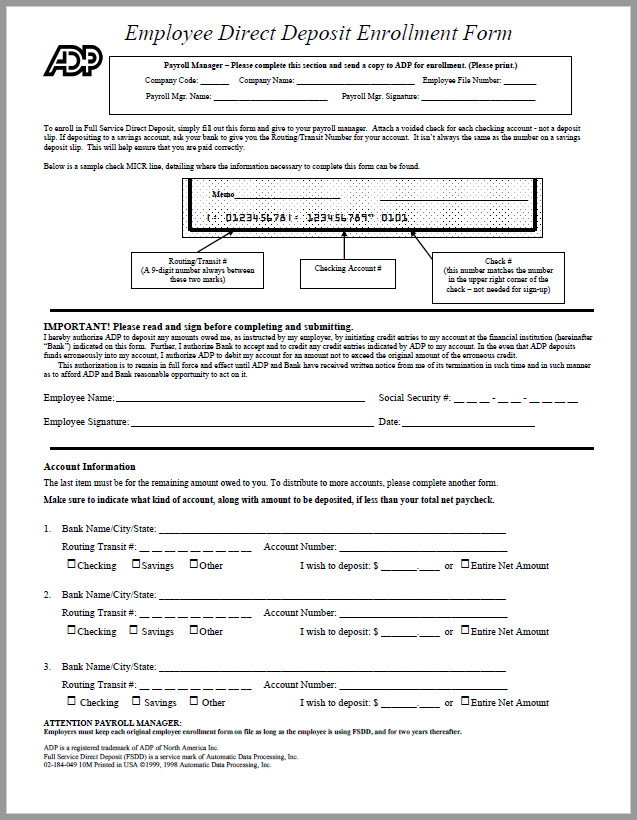

Examples of Direct Deposit Enrollment Forms

Direct deposit enrollment forms may vary slightly depending on the employer or payer. However, most forms will include similar sections and fields. Here are a few examples of what a direct deposit enrollment form may look like:

Tips for Successful Direct Deposit Enrollment

Here are some tips to ensure a successful direct deposit enrollment:

- Double-check your bank account details: Ensure that you provide accurate bank account and routing numbers to avoid any payment delays or errors.

- Keep a copy of the completed form: Make a copy of the completed form for your records. This will come in handy if you need to reference the information in the future.

- Follow up with your employer or payer: Confirm with your employer or payer that they have received and processed your direct deposit enrollment form. This will give you peace of mind that your direct deposit is set up correctly.

- Update your information as needed: If there are any changes to your bank account or personal information, promptly update your direct deposit enrollment form to ensure uninterrupted payments.

- Monitor your bank account: Regularly check your bank account to ensure that direct deposits are being made correctly and on time.

Conclusion

A direct deposit enrollment form is a convenient and efficient way for individuals to receive payments directly into their bank accounts. By completing this form, individuals authorize their employer or other payer to electronically deposit funds, eliminating the need for physical checks.

Following the provided instructions and tips will ensure a successful direct deposit enrollment, allowing individuals to enjoy the benefits of this payment method.

Direct Deposit Enrollment Form – Download