When donating to a charitable organization, keeping track of your contributions for various reasons is crucial. One of the most important aspects of donating is receiving a donation receipt. This written acknowledgment not only serves as official documentation of your gift but also allows you to claim tax deductions on your income tax return. Additionally, donation receipts help charitable organizations keep track of donations and express gratitude to donors.

In this article, we will explore the significance of donation receipts, why they are essential, how to obtain them, and some tips for successful donation tracking.

What is a Donation Receipt?

A donation receipt is a written acknowledgment that a donor has contributed to a charitable organization. It provides official documentation of their gift and allows them to claim tax deductions on their income tax return.

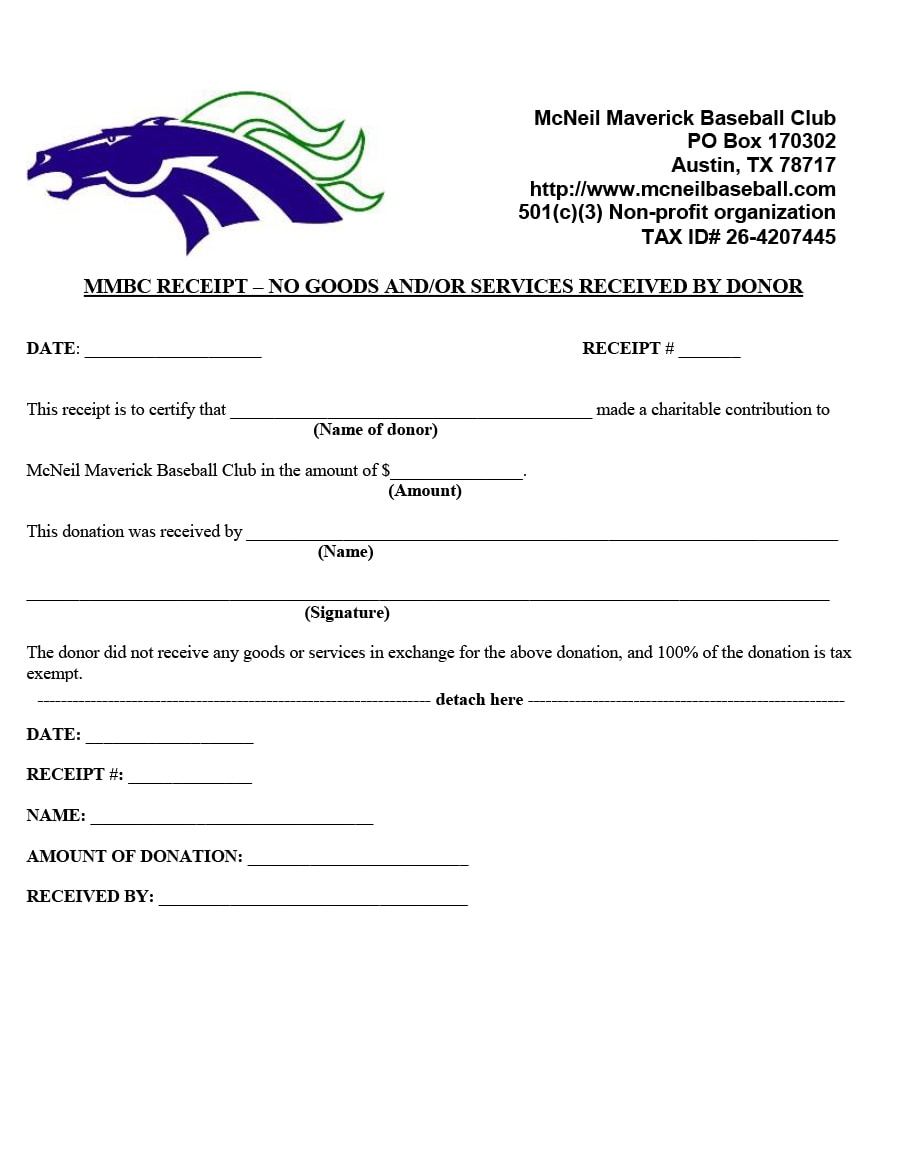

These receipts typically include important details such as the donor’s name, the charitable organization’s name and address, the date of the donation, a description of the donated item or amount, and a statement confirming that no goods or services were received in exchange for the donation.

Why are Donation Receipts Important?

There are several reasons why donation receipts are crucial for both donors and charitable organizations:

- Claiming Tax Deductions: Donors can claim tax deductions on their income tax return by providing documentation of their charitable contributions. donation receipts serve as the required proof for claiming these deductions.

- Keeping Track of Donations: donation receipts help both donors and charitable organizations keep track of contributions. Donors can refer to these receipts when preparing their taxes or for personal record-keeping purposes. Charitable organizations can use them to maintain accurate records of donations and identify their generous supporters.

- Expressing Gratitude to Donors: donation receipts also serve as an opportunity for charitable organizations to express gratitude to their donors. Including a personalized thank-you message or showcasing the impact of the donation can help strengthen the relationship between the organization and its supporters.

How to Obtain a Donation Receipt?

Obtaining a donation receipt is a relatively straightforward process. Here are the steps you need to follow:

- Contact the Charitable Organization: Reach out to the charitable organization you donated to and request a donation receipt. Provide them with the necessary details such as your name, the date of the donation, and the amount or description of the contribution.

- Confirm Receipt of Donation: The charitable organization will verify your donation and prepare the receipt. They may require additional information or documentation to complete the process.

- Receive the Receipt: Once the charitable organization has processed your request, they will provide you with a donation receipt. This can be sent to you via email or mail, depending on your preference.

Tips for Successful Donation Tracking

Keeping track of your charitable contributions can be a daunting task, especially if you make multiple donations throughout the year. Here are some tips to help you successfully track your donations:

- Maintain Organized Records: Create a dedicated folder or file where you can store all your donation receipts. Keep them in chronological order for easy reference when needed.

- Utilize Technology: Consider using digital tools or apps specifically designed for donation tracking. These tools can help automate the process and provide you with a clear overview of your contributions.

- Set Reminders: Mark important dates, such as tax filing deadlines or the end of the calendar year, on your calendar. This will serve as a reminder to gather all your donation receipts and prepare them for tax purposes.

- Consult a Tax Professional: If you have any doubts or questions regarding tax deductions related to your donations, it’s always a good idea to consult a tax professional. They can provide you with expert advice and ensure that you maximize your deductions while staying compliant with tax laws.

- Consider Regular Contributions: Making regular contributions to charitable organizations can simplify the donation tracking process. By setting up recurring donations, you can receive a consolidated donation receipt at the end of each year, reducing the administrative burden.

- Keep Communication Records: In addition to donation receipts, it’s helpful to keep records of any communication with charitable organizations. This includes emails, letters, or any other documentation that verifies your donations or interactions with the organization.

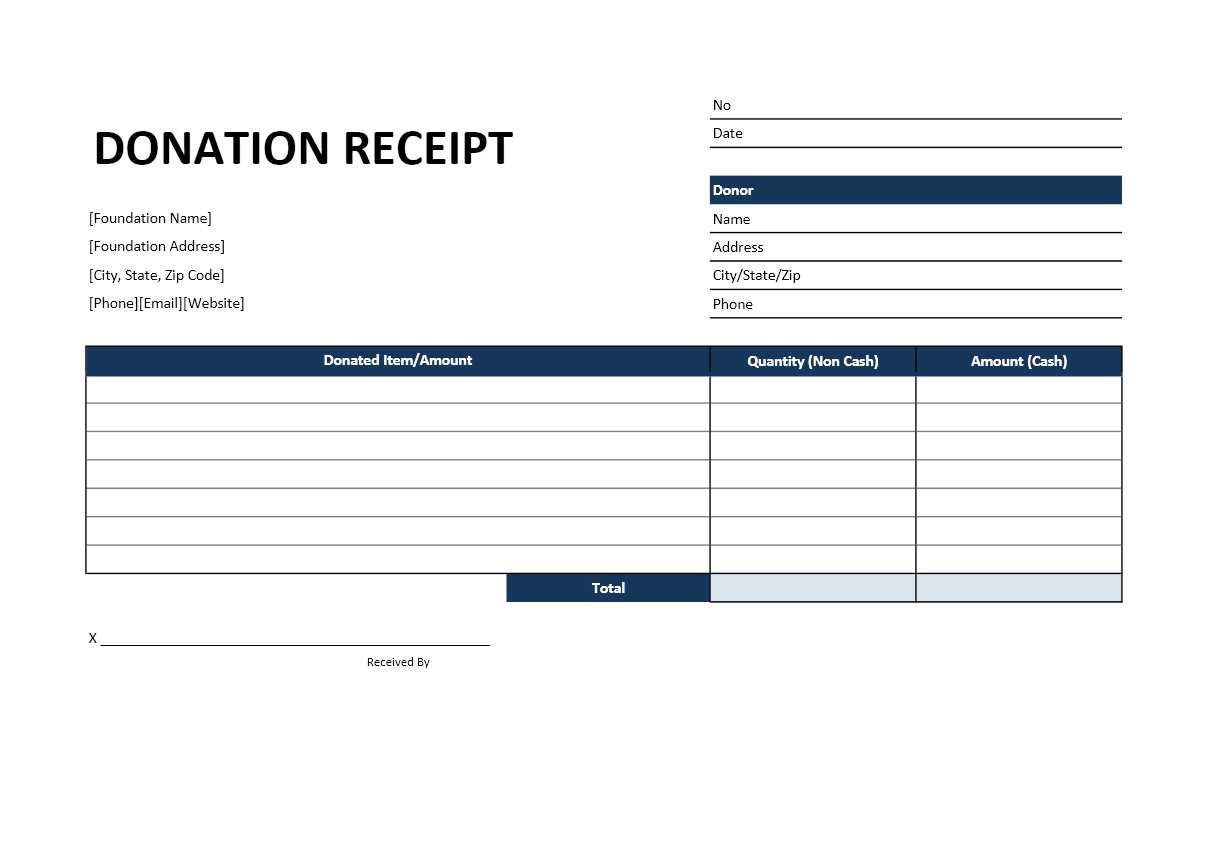

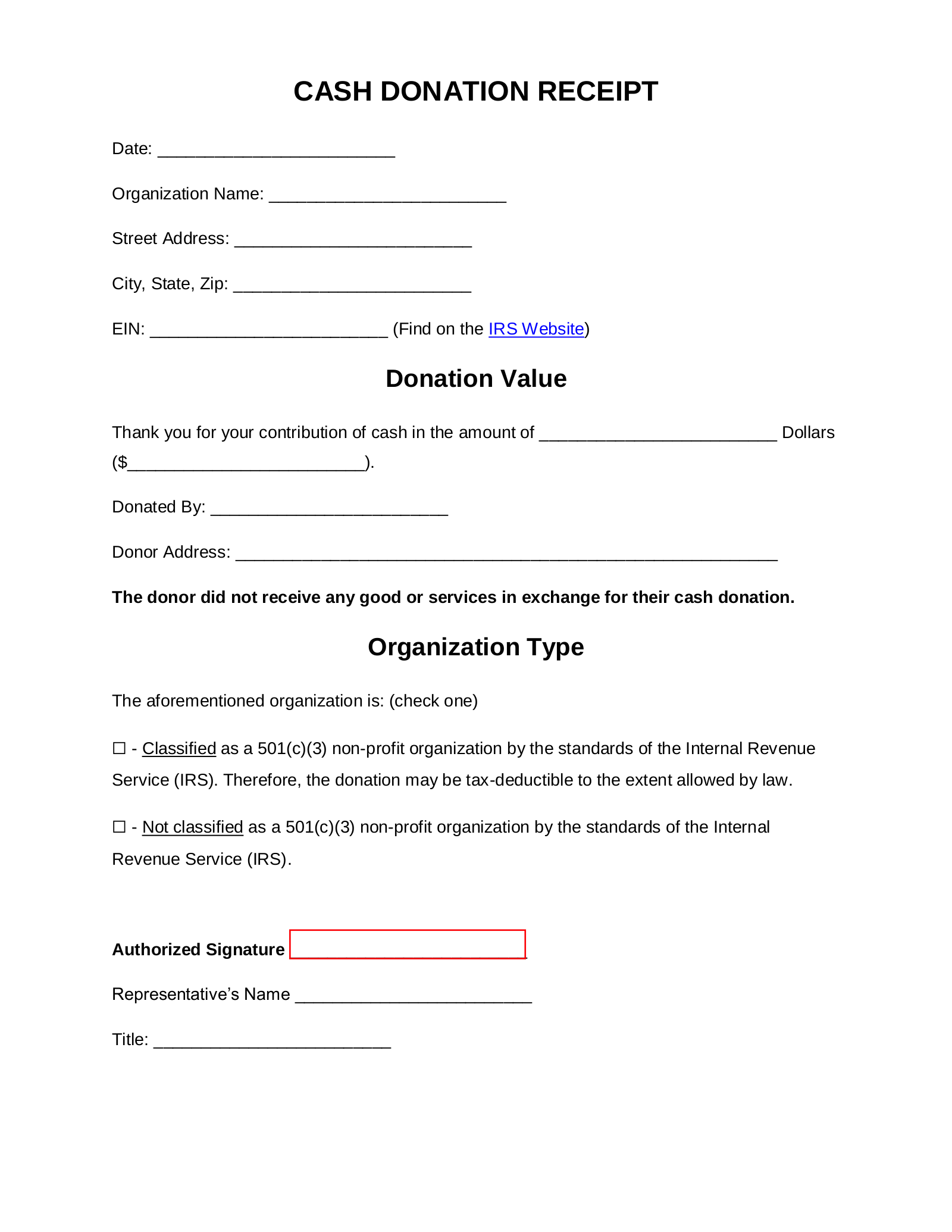

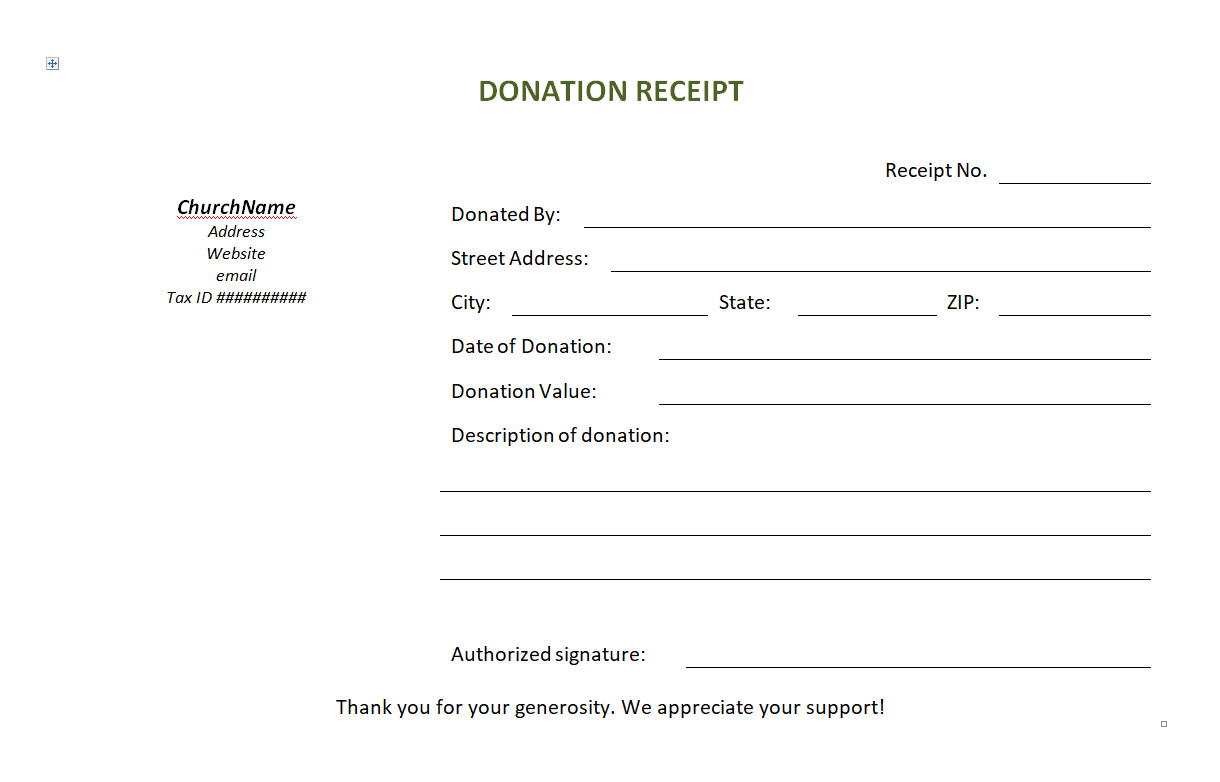

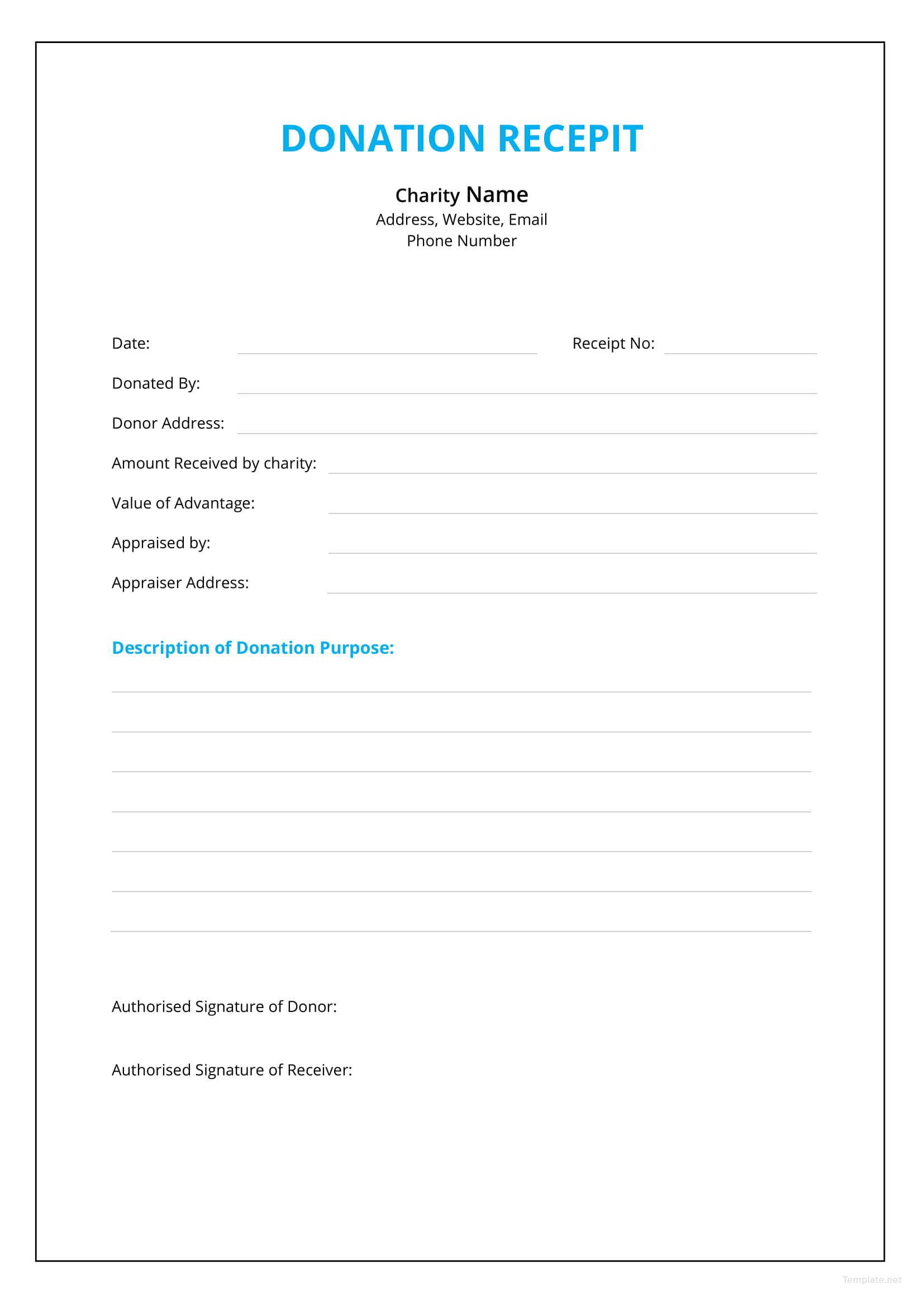

Examples of Donation Receipts

To provide you with a better understanding of what donation receipts look like, here are a few examples:

In Conclusion

Donation receipts play a vital role in the world of charitable giving. They provide donors with the necessary documentation to claim tax deductions and help organizations keep track of contributions. By understanding the importance of donation receipts, learning how to obtain them, and following some tips for successful donation tracking, you can ensure that your charitable contributions are properly recorded and acknowledged.

So, the next time you donate, don’t forget to request your donation receipt and keep it in a safe place!

Donation Receipt Template – Download